Your auto parts e-commerce sells, but doesn’t grow? The problem may lie in your product mix

In the auto parts sector, many online retailers face a recurring dilemma: even with regular sales, sustainable business growth seems stuck. One of the most common reasons for this scenario lies in how the product mix is structured. Even today, it’s common for parts and accessories catalogs to be built based on personal preferences, supplier agreements, or perceived “best-selling items” — without considering the customer’s actual journey and the strategic role of each product.

To unlock growth, it’s necessary to go beyond guesswork. A smart, data-driven mix can boost the three key drivers of any auto parts e-commerce: new customer acquisition, recurring repurchases, and satisfaction with the shopping experience.

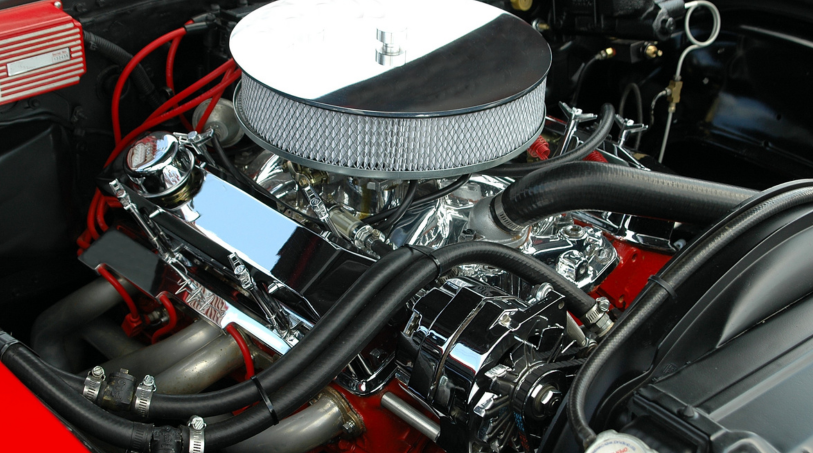

Strategic mix: the silent engine of growth

Companies with strong digital operations in the automotive sector typically structure their portfolios into three major product groups, each with a clear function within the revenue and loyalty strategy. The secret lies in the proportion and the role each product plays.

- Attraction products: generate traffic, not profit

High-demand items such as oil filters, brake pads, or windshield wipers, usually competitively priced and widely sought after, are ideal for attracting traffic. These products account for an average of 60% of revenue in the most efficient stores, not because they’re the most profitable, but because they increase the top of the sales funnel.

By offering these items under attractive conditions, the store becomes a go-to reference for customers on their first purchase. And even with tight margins, they serve as an entry point for long-term commercial relationships.

- High-margin products: sustaining profitability

Specific, higher-value parts, such as sensors, electronic modules, premium shock absorbers, or clutch kits, usually face less direct competition and yield higher margins. Although they represent around 30% of total revenue, these products are crucial for profitability.

They’re ideal for upsell or cross-sell strategies, working as a complement to the main sale. For example, a customer searching for brake pads may also be offered a complete maintenance kit, increasing the average ticket size and overall profit per transaction.

- Desire products: strengthening the brand

In the automotive world, there are also products that evoke passion, like sport steering wheels, personalization accessories, or LED lights. With strong visual appeal and impulse-buy potential, they represent only about 10% of revenue, but they are key to strengthening brand positioning, generating buzz, and differentiation.

These products reinforce the store’s reputation as a specialist, even if they’re not top sellers.

From inventory to strategy: a catalog that aligns with the customer journey

Building a portfolio based solely on supplier availability or store owner preference is a common mistake. Auto parts customers go through different stages in their journey: emergency purchases, scheduled maintenance, or upgrades driven by desire, among others. A smart mix should address all these moments.

More than quantity, what distinguishes a successful operation is intentionality. Each product should serve a strategic purpose: attracting new customers, improving profitability, or creating engagement with the brand.

A product mix that drives growth

In auto parts e-commerce, growth doesn’t come just from selling more, but from selling with purpose. A strategic portfolio aligned with the customer journey and supported by data helps reduce acquisition costs, increase average ticket size, and build long-term relationships with end consumers, workshops, and distributors.

By professionalizing the product mix curation, retailers stop operating in the dark and start acting with clarity, efficiency, and long-term vision accelerating growth in a consistent and profitable way.