In Latin America, the digital transformation of the automotive sector is going beyond just buying and selling vehicles. While the market often focuses on new or used cars, a key part of the business — the sale of auto parts and after-sales services — is undergoing a quiet revolution. At the heart of this transformation are strategic alliances between automakers and dealerships, which are now beginning to operate under integrated structures and digital models that are reshaping how inventory is managed, how end customers are served, and how replacement parts are sold online.

A relationship that goes beyond car sales

Dealerships are independent companies authorized by manufacturers to sell their vehicles under a franchise contract. Historically focused on direct vehicle sales to the public, in recent years, after-sales has become a vital link in the value chain.

According to the Argentine Chamber of Electronic Commerce (CACE), in 2023 the automotive sector's digital channel — which includes vehicles, parts, and accessories — grew by 22%, generating over 3.5 trillion pesos in revenue. This growth reflects the increasing adoption of digital platforms for auto parts and after-sales services, with dealerships playing a key role in integrating these processes and expanding online sales channels.

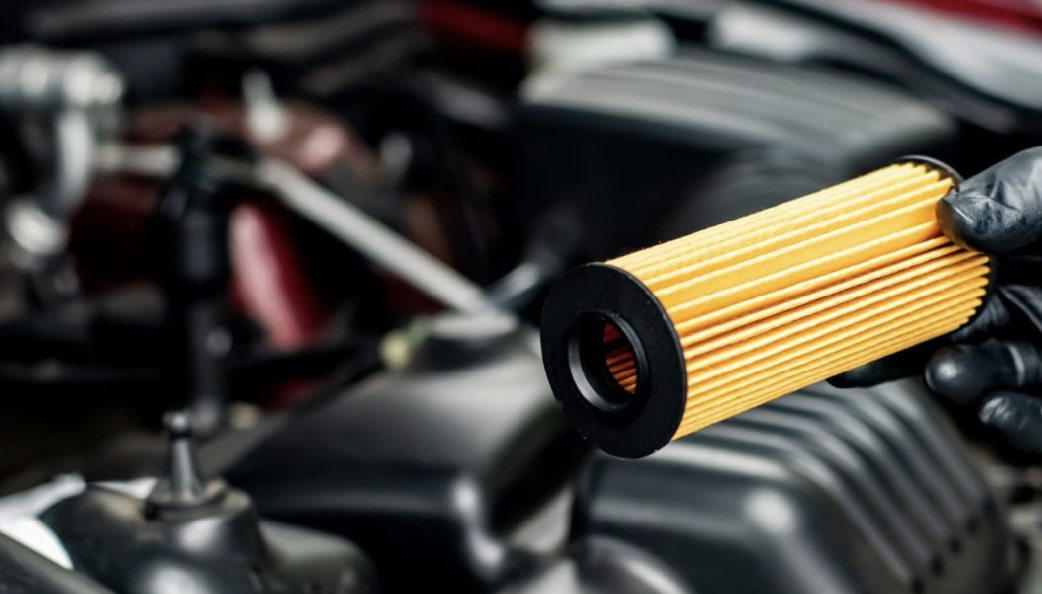

This surge represents not only increased sales volume but also a transformation in operations. Today, both brands and dealers understand that the business doesn’t end with delivering the vehicle — it starts there. In this context, parts sales are gaining prominence, driven by the aging vehicle fleet in LATAM and growing maintenance needs.

Digitalization as a driver of change

Faced with more informed and demanding consumers, the industry is turning to digital platforms that enable real-time price updates, inventory visibility, and purchasing from any device. Platforms like Alephee are enabling automakers such as General Motors, Renault, Stellantis (Mopar), and BMW to centralize their catalogs and connect their dealership networks through official multi-seller store models.

For example, Chevrolet has implemented a model where dealerships can sell original auto parts directly through a shared official store. This integration provides full visibility over sales, digitized supply, and online operations across the commercial network. Additionally, with systems compatible with multiple catalogs, it becomes easier for end users to search for parts, reducing errors and boosting confidence in the buying process.

Renault: a customer-centric success story

Renault has focused its digital strategy on enhancing the after-sales experience. The brand created a specialized customer service center for after-sales inquiries and configured its official store with over 5,000 products, aiming to reach 10,000 SKUs. Moreover, its dealership network serves as official pick-up points, creating a hybrid (digital and physical) customer experience that meets new consumer expectations.

What changes for the end customer?

This transformation improves not only brand and dealership operations but also directly impacts workshops, retailers, and individual buyers. Today, users can search for the best option from their phones, check compatibility, verify immediate availability, and receive their products at a workshop or pick them up from a nearby dealership — without visiting multiple stores or calling to confirm stock.

In a market where logistical errors cause significant losses, digitalizing catalogs, inventories, and prices helps prevent stockouts and ensures faster deliveries. Confidence also increases when customers can verify that a part is original, compatible, and sourced directly from the official channel.

Trends: the rise of auto parts e-commerce

According to Google, 92% of car buyers begin their search online. This behavior extends to the auto parts market as well. Distributors already operating on digital platforms report greater reach and operational efficiency. For example, in Mexico, the used car segment accounted for 14.7% of dealership sales in 2023, according to Simindex. Although this percentage has declined in recent years, the aging vehicle fleet has boosted parts sales, offsetting the drop in vehicle turnover.

This phenomenon positions after-sales as a key channel for sustainable revenue among distributors and dealerships adapting to the digital environment.

A new industry standard

In summary, what began as a response to changing consumer habits is now solidifying as a new standard in the auto parts and after-sales industry. The integration between automakers, dealerships, and tech platforms like Alephee not only optimizes processes — it redefines customer relationships, improves efficiency, and expands sales channel reach.

In a region like LATAM, where logistical challenges abound, this digital transformation is not just a competitive advantage — it’s a necessity.