The automotive market in Mexico is undergoing a profound transformation. While new vehicle sales continue to grow at a moderate but steady pace, the digitalization of the purchasing process is accelerating consistently. According to INEGI data, 1,496,806 light vehicles were sold in 2024, representing a 9.8% increase compared to 2023. In 2025, through November, cumulative sales reached 1,370,186 units, reflecting a year-over-year growth of 1.0% and confirming that the sector is now operating above pre-pandemic levels.

Mercado Libre: the leading e-commerce platform for auto parts sales in Mexico

At the same time, digital channels continue to gain prominence. Mercado Libre has reaffirmed its leadership in Mexico and across Latin America, with a 28% increase in GMV in the last quarter and 27% more items sold compared to the previous year. This e-commerce momentum is creating opportunities for automotive brands to capitalize on new consumption habits, especially among users who value speed, availability, and simpler purchasing experiences.

For the Volkswagen brand in Mexico together with its dealer network, parts division, and after-sales operations this scenario became a turning point. The brand recognized that consumers are increasingly comfortable purchasing auto parts and automotive solutions through e-commerce platforms, a behavior that has shifted from trend to routine.

Volkswagen accelerates its digital strategy

Volkswagen Mexico has consolidated its position as one of the Group’s strategic pillars in North America, not only due to its relevance in the local automotive industry, but also because of its key role in the global reconfiguration of supply chains. In 2025, the company ranks as the third-largest multi-brand group in sales in Mexico, reaching an 11.5% market share and reinforcing its regional relevance, as highlighted by Natalia Villegas, Volkswagen channel specialist.

This strength is supported by a robust global presence. The Volkswagen brand sells vehicles in more than 150 countries and is part of an industrial group operating 119 production plants in 21 countries, including strategic hubs in Germany, Mexico, Brazil, and Argentina. Within this extensive industrial footprint, Mexico plays a crucial role in exports and in supplying key models to multiple markets.

As Natalia, sales channel specialist, explains, “In the local context, Volkswagen Mexico is going through a decisive moment. With close to a 9% share of the new vehicle market, the company remains among the three most relevant brands in the country thanks to a mature operation that integrates production, sales, and after-sales.” Its portfolio includes the main models sold in Mexico, such as Jetta, Tiguan, Taos, Virtus, Nivus, Tera, Amarok, and Crafter, as well as historically high-volume models like Vento, Polo, Gol, and Jetta Clásico.

The rationale behind Volkswagen’s digital bet in Mexico

Volkswagen’s entry into e-commerce in Mexico is not an isolated experiment, but a strategic move aligned with the digital transformation of the automotive industry and the need to modernize the after-sales experience both for current customers and for those who previously owned the brand and need parts for vehicles over four years old.

Currently, the brand operates exclusively online through its Official Store on Mercado Libre, launched under a multi-seller sales model with 23 authorized dealerships selling exclusively on the platform. The plan for next year is to reach 50 distributors.

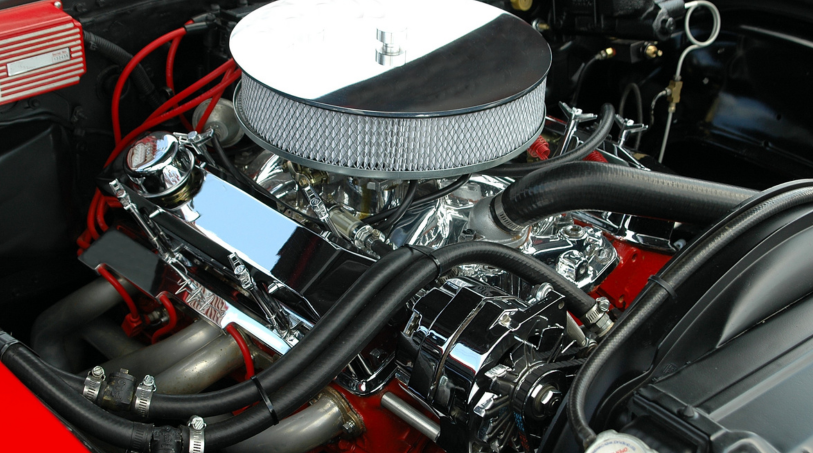

In this new digital space, the Volkswagen brand consolidates the full strength of its commercial and after-sales operations with an initial offering of more than 4,000 SKUs in its catalog of original parts, auto parts, and accessories, covering maintenance, wear, collision, engine, suspension, brakes, and customization needs.

According to Natalia Villegas, Volkswagen e-commerce specialist, this digital evolution is driven by three main pillars aimed at expanding the availability of original parts, strengthening the customer experience, and modernizing interaction with the dealer network.

The customer is already digital: automotive consumers research online, compare prices, and demand convenience. Being present where they buy today is essential.

The market demands omnichannel strategies: after-sales no longer depends exclusively on physical distributors. Digital platforms offer immediate availability, fast delivery, and greater transparency for users.

A strong portfolio boosts marketplace performance: with a broad and competitive product line, the Volkswagen brand finds platforms like Mercado Libre to be the ideal environment to scale its presence and reinforce buyer trust a decisive factor in conversion.

Volkswagen’s path in Mexico toward a digital after-sales model

Volkswagen’s digital transformation in Mexico was not without challenges. However, each obstacle became a strategic opportunity to accelerate the brand’s modernization in an automotive market rapidly shifting toward more digital, measurable, and consumer-centric sales models.

1. From a traditional culture to digital evolution

For decades, automotive after-sales operated entirely in-person. Migrating this logic to a marketplace required breaking paradigms, training new profiles, and reconfiguring internal operations. What initially seemed challenging became the engine for professionalizing and standardizing the dealer network.

2. Mercado Libre as the gateway to digital consumers

Volkswagen’s arrival on Mercado Libre significantly expanded its exposure in a highly competitive market while granting immediate access to millions of potential buyers.

3. “El Buen Fin”: the first major test

Launching the official store just weeks before the most important commercial event of the year represented considerable risk. Still, Volkswagen exceeded its targets before the event ended.

4. A more integrated and stronger dealer network

Digitalization did not replace distributors it strengthened them. Today, more than 20 dealerships across Mexico actively operate online in a coordinated and efficient network.

Redefining the present, accelerating the future

Volkswagen’s digital bet in Mexico marked a turning point. What began as an online store quickly became a national strategic channel.

As Natalia Villegas highlights: “More than launching an online store, the brand charted the path toward a more modern, accessible, and future-ready after-sales model. And we believe that this partnership with Alephee will take us even further.”