Sustained growth, nearshoring and regional leadership power Mexico’s auto parts industry

Mexico continues to strengthen its position as the undisputed leader in auto parts exports to the United States, far surpassing traditional competitors like Canada and China. In a global context of industrial reshaping, Mexico has successfully leveraged its competitive advantages to become a strategic partner in North America’s automotive supply chain.

According to the National Auto Parts Industry (INA), between January and August 2024, Mexico accounted for 43.1% of U.S. auto parts imports, solidifying its status as the leading supplier of components for both light and heavy vehicles. In comparison, Canada holds 10% and China just 7.7%, highlighting Mexico’s significant lead in the international competition.

From 29% to over 43%: a strategic evolution

Mexico’s rise hasn’t happened overnight. In 2007, it represented 29.8% of U.S. imports in the sector. Seventeen years later, the figure exceeds 43%, reflecting a steady upward trend despite global logistical and economic challenges.

This performance is closely tied to the nearshoring trend, which has prompted European and U.S. companies to relocate operations from Asia, primarily China, to Mexico, seeking shorter distances, lower logistics costs, and the benefits of USMCA regulations, which require at least 75% regional content in automotive products.

Dynamic exports and growing trade surplus

In the first eight months of 2024, Mexico’s auto parts exports reached $72.55 billion, a 3.8% increase compared to the same period in 2023. While 87.4% of those exports went to the U.S., Mexico also supplies over 15 other countries, consolidating its position as a global player.

Meanwhile, sector imports rose 3.6%, totaling $46.96 billion. Still, Mexico maintains a solid trade surplus: in 2024, the positive balance reached $25.59 billion — 4% higher than in 2023.

Innovation, added value, and electromobility

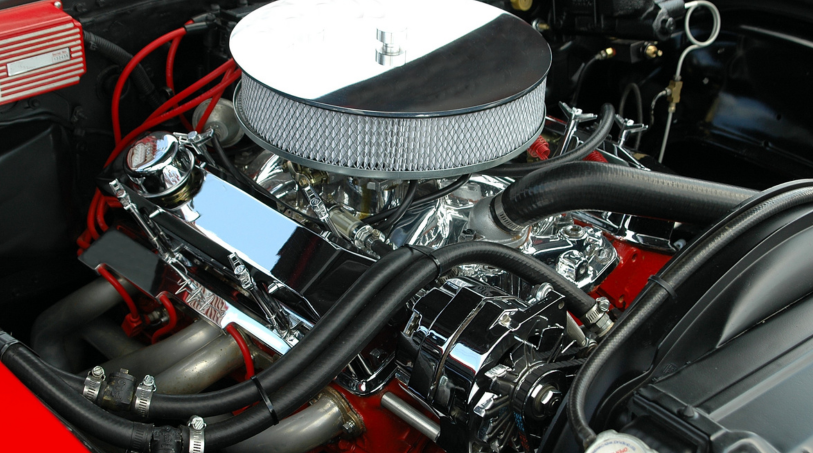

INA President Francisco González emphasized that the growth is not only quantitative, but also qualitative. “Today, the auto parts we export have more added value. Mexico is not just assembling, we’re designing, innovating, and evolving into a smarter and more sustainable industry,” he said.

Electromobility represents the next major challenge and opportunity. As the region shifts toward cleaner vehicles, demand for specialized components such as battery management systems, power electronics, and smart sensors is rising rapidly. With strong infrastructure and skilled labor, Mexico is well positioned to play a key role in this transition.

A strengthened ecosystem

Mexico’s automotive ecosystem combines world-class local companies like Katcon, Metalsa, Vitro, Rassini, Sisamex, KUO, and Nemak with global giants such as Bosch, Continental, Denso, ZF, Autoliv, Magna, and Valeo. These companies produce everything from brakes and transmissions to advanced driver-assistance systems and safety technologies.

Combined with a highly competitive cost structure, strategic geographic location, and deep regional integration, Mexico stands out not only as an efficient supplier but as a reliable long-term partner for the global automotive industry.