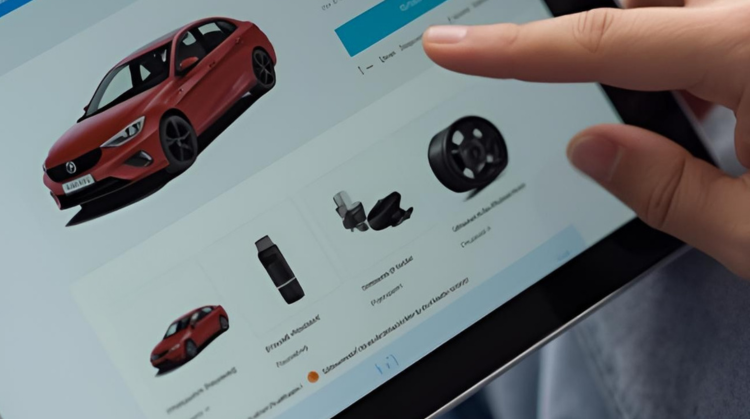

As digital transformation accelerates in the automotive retail sector, heavy vehicles including trucks, buses, and agricultural machinery are beginning to take up meaningful space on e-commerce platforms. For manufacturers, distributors, and brands operating in this niche, opening an official store on marketplaces like Mercado Livre represents not just a new sales channel, but a concrete opportunity for growth and nationwide presence.

A Growing Online Market for Heavy Vehicles

Brazil has the third-largest truck fleet in Latin America, with over 2.2 million commercial vehicles in circulation, according to Fenabrave (2024). This volume demands constant maintenance and a strong replacement parts supply chain.

In response, digital platforms have been enhancing the categorization of heavy vehicle parts and accessories. Mercado Livre, for instance, has shown significant growth in sales of truck and bus parts. According to a study conducted by the platform in partnership with Nielsen, the segment grew 29% in online sales in 2023, driven by independent repair shops and small to mid-sized transport companies now buying directly through marketplaces.

Why Open an Official Store in E-commerce?

Brands and manufacturers in the heavy vehicle segment that invest in structured digital channels gain several clear advantages:

- Geographic expansion: reach regions beyond the limits of traditional distribution;

- Process automation: platforms like Alephee allow inventory integration, automated pricing, and bulk listings with technical details;

- Fewer errors: listing compatibility by model, year, and version reduces return rates;

- Brand positioning: official store status increases buyer trust, especially among fleet operators seeking speed and reliability.

Key Platforms for the Heavy Vehicle Segment

In addition to Mercado Livre, which leads in volume and relevance for automotive e-commerce, other platforms are becoming viable channels:

- B2W Marketplace (Americanas Empresas): focused on B2B and distributor sales.

- Magalu: expanding its categories to include heavy-duty vehicles.

- Amazon Brazil: growing its presence in the automotive sector with differentiated logistics.

- Shopee and Mercado de Peças: also targeting specific niches, though with less penetration in commercial vehicles.

Going Digital Means Staying Ahead

According to ABRAPA (Brazilian Association of Auto Parts Resellers), by 2027, nearly 40% of replacement parts sales in Brazil will be through digital channels. For truck parts manufacturers, staying out of this ecosystem could mean losing a significant share of the market, especially as logistics companies, transport operators, and repair shops adopt online purchasing as the norm.

Partnering with integrators like Alephee provides the competitive edge: real-time inventory sync, automated product listings, and reporting tools to guide smart decision-making.