Brazilian agribusiness is experiencing a rapid digitalization wave that extends beyond the production phase. According to the Agri-FoodTech Funding Report, companies and startups in the sector invested over USD 1.1 billion in marketplaces and digital solutions for the sale of inputs and equipment. E-commerce platforms offering everything from technical spare parts to agricultural insurance and financial services are already a reality in Brazil, directly impacting the replacement chain and after-sales service.

Online sales in agri: a technical market with logistical challenges

Despite digital progress, selling inputs and auto parts online to the agricultural sector still requires careful planning. Many products exceed postal size standards, need specialized transport, and must be delivered quickly especially when machines are down during the harvest, where every day of delay causes significant losses. According to CNT, 61.8% of Brazilian highways have infrastructure issues, worsening logistics and demanding a well-prepared network of distributors.

The role of inventory and digital management in supply chain efficiency

Storage capacity is also a bottleneck. According to the FAO, Brazil should be able to store 1.2 times its annual production, yet there have been harvests with a storage deficit of over 90 million tons. This directly affects the distribution of inputs and parts. Having an updated digital catalog with inventory management integrated with ERPs and marketplaces enables faster replacement, reduced waste, and greater predictability throughout the chain.

The rural customer experience and the challenge of remote support

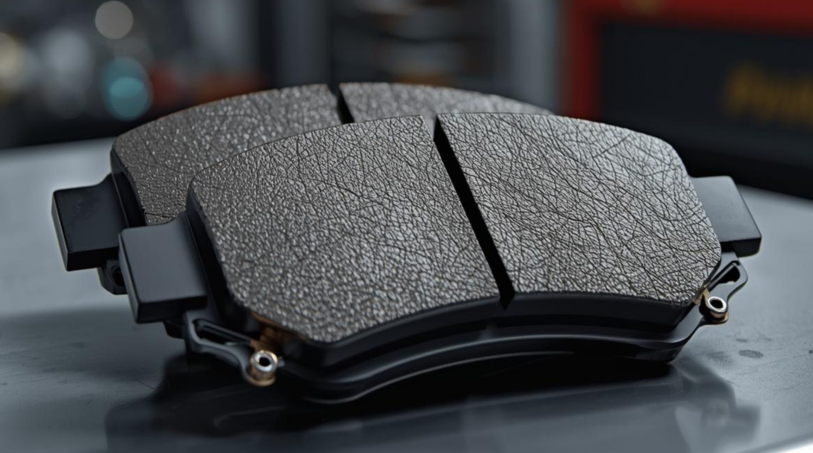

Even as digitalization advances, agricultural customers still value personalized service. This means e-commerce platforms must offer active support channels, clear product information, and reliable logistics. The quality of after-sales support especially in delivering technical products like replacement parts or fertilizers has a direct impact on customer loyalty.

Dealer network engagement and the role of distributors

Another critical factor is integration with the dealer network. Many brands rely on these partners to reach remote regions. Bonus programs, training, and integrated sales systems help keep the network engaged and ensure consistent service delivery.

The future of agri e-commerce: from endpoints to the heart of the chain

The next challenge is to expand this model to the other end of the supply chain: inputs, parts, and equipment. To do so, it’s essential to partner with providers that offer digital infrastructure, industry knowledge, and integrated solutions.

Distributors and manufacturers who invest in well-structured digital operations with a focus on inventory, logistics, and service will be better positioned to meet the demands of an evolving agribusiness sector with speed and precision.